News

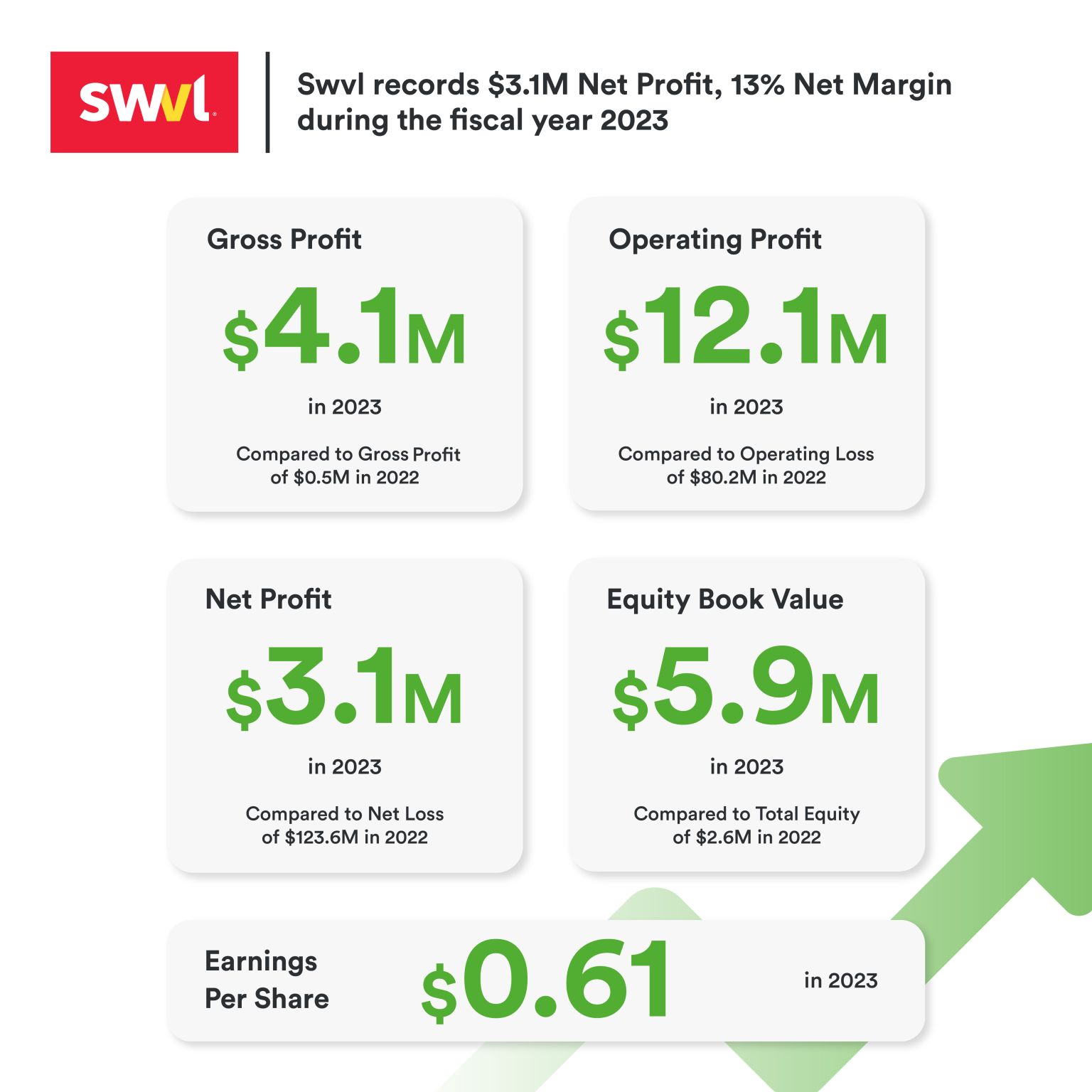

Swvl Records $3.1m Net Profit, 13% Net Margin, and an Eightfold Growth in Gross Profit

April 30, 2024

Swvl Holdings Corp Announces Fiscal Year 2023 Financial Performance

8x Gross Profit Growth Year on Year to $4.1 million

- Achieved cash flow positivity, with self-funded growth.

- Profitable growth drove earnings per share from continuing operations to $0.61.

- Strong balance sheet with no debt and more than doubled positive equity value compared to 2022.

DUBAI, United Arab Emirates, April 30, 2024 (GLOBE NEWSWIRE) – Swvl Holdings Corp (“Swvl” or the “Company”) (Nasdaq: SWVL), a technology provider for enterprise and government mobility solutions with a global footprint, announces a significant achievement in its financial performance for the fiscal year 2023. The Company has successfully delivered positive net profit and cash flow for the full year.

Continuing the positive momentum established in the initial half of the fiscal year, Swvl completed the path to profitability program initiated in 2022. The Company is committed to boosting profitability further while concurrently resuming strategic expansions into high-revenue markets.

This result marks Swvl’s swift transition to profitability, highlighting a focus on financial stability and operational efficiency, and the effective implementation of profitability strategies during the fiscal year. The Company’s continuous efforts to maintain positive cash flow and profitability support its upcoming planned expansion into high-revenue markets.

CEO’s Statement

Mostafa Kandil, CEO of Swvl, stated:

“In 2023, our team demonstrated exceptional skill and dedication, achieving profitability. As we advance, our commitment to innovation will be marked by the launch of a wide range of products slated for the upcoming year and for our new potential markets. Additionally, in the meantime, we are expanding our strategic partnerships into more Gulf Cooperation Council (GCC) countries. Our focus today remains towards improving profitability while resuming our high-paced growth.”

Post December 31, 2023, Swvl continued to make strides to further solidify its financial position, focusing on increasing margins and maintaining efficient operations. Swvl remains focused on sustaining this positive momentum, further strengthening its financial position, and continuing to deliver enhanced value to its shareholders and stakeholders in the future of the mobility landscape.

For detailed financial information, please see Appendix A for the consolidated financial statements. This press release, along with complete financial statements and the investor presentation, can be found in the Investor Relations section of Swvl’s website at https://www.swvl.com.

Forward-Looking Statements

This press release contains “forward-looking statements” relating to future events. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to, statements regarding future events and other statements that are not historical facts. For example, Swvl is using forward-looking statements when it discusses its commitment to boosting profitability further while concurrently resuming strategic expansions into high-revenue markets, its intention to launch a wide range of products slated for the upcoming year, its intention to expand strategic partnerships into more GCC countries, and its focus on improving profitability while resuming its high-paced growth.

These statements are based on the current expectations of Swvl’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Swvl. These statements are subject to a number of risks and uncertainties regarding Swvl’s business, and actual results may differ materially.

In addition, forward-looking statements provide Swvl’s expectations, plans, or forecasts of future events and views as of the date of this communication. Swvl anticipates that subsequent events and developments could cause Swvl’s assessments and projections to change. However, while Swvl may elect to update these forward-looking statements in the future, Swvl specifically disclaims any obligation to do so.

These forward-looking statements should not be relied upon as representing Swvl’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon any forward-looking statements. Except as otherwise required by law, Swvl undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

More detailed information about the risks and uncertainties affecting the Company is contained under the heading “Risk Factors” in the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (the “SEC”), which is available on the SEC’s website, www.sec.gov, and in subsequent SEC filings.

Stay Updated

Stay connected and receive new news in your inbox.